Debt Syndication

We offer comprehensive debt syndication services to both corporate and retail clients seeking to raise funds through various loan instruments. Our team assists in identifying the most suitable financing options, preparing detailed financial proposals, and connecting clients with an extensive network of banks, financial institutions, and NBFCs. We manage the entire process—from assessing funding requirements and structuring the loan to facilitating negotiations and ensuring timely sanction and disbursement. With a strong focus on transparency, compliance, and strategic financial planning, we help clients secure the optimal debt solution to support their business growth, expansion, or personal funding needs.

We offer the subsequent services to clients in raising debt

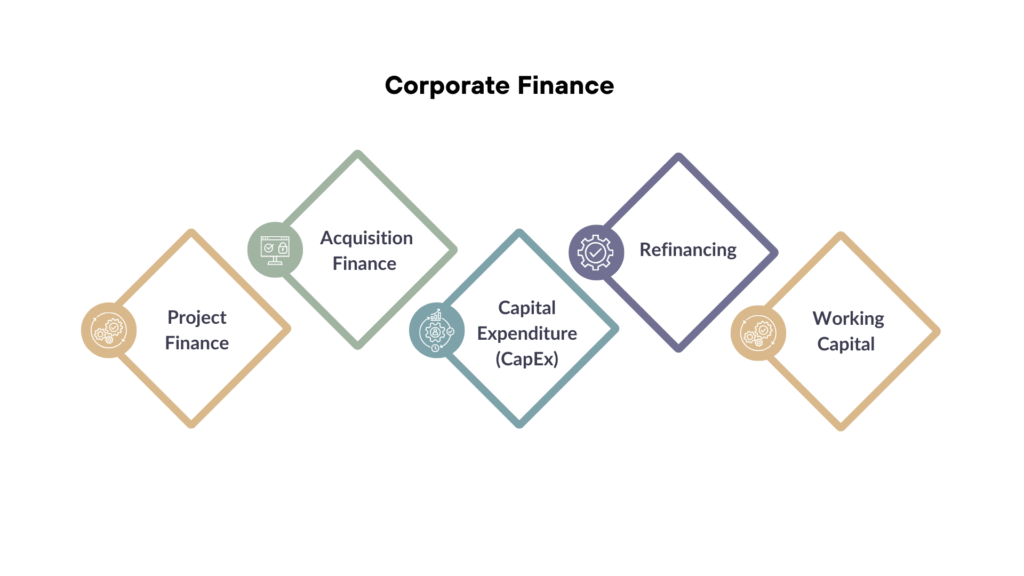

- Corporate Finance

- We specialize in providing end-to-end debt syndication solutions for corporates across industries. Our expertise lies in structuring and arranging funds for:

- Project Finance – Comprehensive funding solutions for large-scale projects and expansions.

- Acquisition Finance – Tailored financing to support mergers, acquisitions, and strategic investments.

- Capital Expenditure (CapEx) – Funding for infrastructure, machinery, and technology upgrades

- Refinancing – Optimizing existing debt to reduce interest costs and improve financial flexibility.

- Working Capital – Ensuring seamless liquidity to meet day-to-day operational requirements.

- With strong relationships across banks, NBFCs, and financial institutions, we ensure our clients access cost-effective, timely, and structured financing solutions that align with their business objectives.

- Retail Finance

- We provide tailored financial solutions to meet the diverse needs of individuals and small businesses. Our retail finance services are designed to make funding accessible, affordable, and convenient.

- Home Loans – Financing for purchasing or constructing residential property.

- Loan Against Property – Unlocking the value of real estate to meet personal or business needs.

- Personal Loans – Quick, collateral-free loans for urgent financial requirements.

- Vehicle Loans – Financing options for cars, commercial vehicles, and two-wheelers.

- Education Loans – Funding higher studies in India or abroad.

- Business Loans for SMEs/MSMEs – Flexible financing to support business growth and expansion.

- With strong partnerships across leading banks and NBFCs, we ensure our clients receive the best possible loan structures, competitive interest rates, and smooth disbursement processes.